|

To all of our tax customers -- Illinois has extended the state income tax filing deadline to match the current federal extension of July 15, 2020. Taxpayers are encourage to file earlier if they are expecting refunds. Please refer to the attached announcements.

0 Comments

To Our Valued Customers:

We at CLFEM will continue to serve you through the current COVID-19 crisis. Under Governor Pritzker’s most recent order, legal services have been deemed an essential service. We agree. At the same time, we will limit areas of common contact with clients whenever necessary for all of our protection. Starting March 23, we will be limiting physical access to our offices in Pontiac, Chenoa, and Bloomington. We, however, continue to address your needs by email, telephone, and fax. For Chenoa and Bloomington we can be reached at 815.945.2611 during our normal business hours. Our Pontiac number is 815.842.1112. Please be advised that, per recent announcement by the IRS, the tax filing deadline for this year has been continued to July 15, 2020. For those of our clients that currently have cases, including estate and probate, filed in Illinois courts, please be advised that there will delays in some of these matters due to limited court access. Please call us during normal business hours with any questions or concerns. Sincerely, CLFEM Partners CLICK HERE TO READ ABOUT THE NEW TAX DEADLINE CLICK HERE TO READ THE FULL EXECUTIVE ORDER Our Bloomington Office is now located at 2404 E. Empire Street, 2nd Floor, Room 227 in the Cybernautics building right across from the airport. Please call us at 815-945-2611 for an appointment today!

Because your out-of-pocket medical and dental expenses can impact your taxes, keeping good records during the course of the year is important. Taxpayers can claim medical expenses paid for in 2016 if they itemize deductions of their federal tax return--meaning the taxpayer has determined overall deductions are larger than the standard deduction. For 2016, the standard deduction for married filing jointly is $12,600 and $6,300 for individuals.

Qualifying Expenses: Most medical and dental costs paid out-of-pocket, including insurance premiums, can be deducted. Long-term care insurance, in some cases, may also qualify. For those instances where you are traveling longer distances for health care, keep track of the mileage. The 2016 medical rate is 19 cents per mile. Note: You cannot claim deduction for expenses already covered from a Health Saving Account or Flexible Spending Arrangement. Call our firm at 815.842.1112 to set up your tax appointment today. We can and will guide you through your medical itemized deductions as well as other deductions for which you may qualify. It has been announced that the Internal Revenue Service will start accepting and processing 2016 federal individual income tax returns this year. You will have until Tuesday, April 18, 2017 to file your 2016 return.

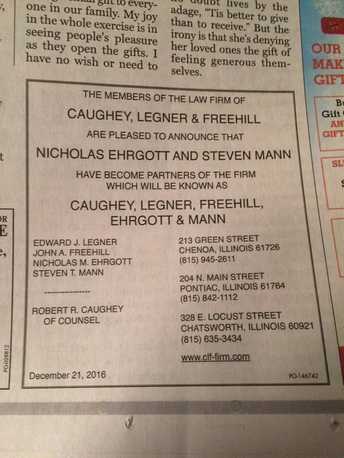

Expect refund delays this year as the IRS will be enforcing the Protecting Americans from Tax Hikes (PATH) Act, which requires the IRS to hold returns which claim Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) as a fraud prevention mechanism. Most refunds will not be issued until the week of February 27th. Please call our firm at 815.842.1112 or 815.945.2611 to help with your tax needs! We look forward to your call. CAUGHEY, LEGNER, FREEHILL, EHRGOTT & MANN looks forward to meeting your legal needs in the upcoming year!

WE HERE AT CAUGHEY, LEGNER & FREEHILL WISH YOU THE

HAPPIEST OF HOLIDAYS. MERRY CHRISTMAS AND HAPPY NEW YEAR! The Affordable Care Act has brought many changes for employers and employees alike. For those employers that qualify as an ALE--that is an Applicable Large Employer, the designation alone leads to the application of employer shared responsibility provisions as well as employer reporting. The benchmark is at 50 full-time employees, but what do you do with seasonal help? The rule is the following: If your workforce exceeds 50 full-time employees for 120 days or fewer during a calendar year, and the employees in excess are deemed seasonal workers, your organization is not considered an ALE.

We wish all of you from Caughey, Legner, & Freehill, a Happy Thanksgiving! Dear Clients,

Today I received a call from an unknown area code on my cell phone which I assumed was a telemarketer, but much to my surprise, the caller left a voicemail. Upon opening my voicemail, a stern voice indicated to me via a recording, that I was in the process of being sued by the IRS. Even this attorney, who stays abreast of IRS tax scams, was initially taken aback my the severity and tone of the "caller". If you have had a similar experience to me, stay calm and read on.... (1) The IRS reports the most common scams and educates consumers accordingly online. https://www.irs.gov/uac/tax-scams-consumer-alerts This tax year tax fraud has been rampant. (2) Keep in mind, if you have somehow found yourself subject to an IRS audit or are accountable for back taxes, the IRS will have sent you multiple written letters well before any litigation has commenced. The IRS does not use automated voicemail to communicate its dissatisfaction with the taxpayer. It is also helpful to utilize the internet to determine if the caller's number is actually an IRS line. In my case, it turned up as "unknown". (3) Remember, the idea behind extortion is this, get the individual afraid and then extort that fear in order to get money. This is not the way of the IRS. In the event you owe money, you will have received notices indicating in detail the issues with your tax returns and your options to pay any deficits. None of those options will include a lump sum payment by a certain date wired to a bank account or will be accompanied by the immediate threat of litigation. (4) Call Caughey, Legner, and Freehill - 815-842-1112. As your tax preparers, we can educate you on the realties of whether you would be exposed to tax penalties or tax litigation based on the nature of your returns. (5) Finally, the IRS provides a fraud hotline: 1-800-366-4484. When in question, call it. As for this tax payer, I will lift my head up high, double check my credit reports to make sure nothing strange is happening with my social security number, and attempt to live a life free from fear of the IRS. Sincerely, Steven T. Mann Medical Expenses can be a valuable deduction if you qualify for itemized deductions (see our blog post of February 17th, 2016). Potential deductions include:

Keep in mind that travel costs to and from doctors and hospitals are eligible for deductions. For more information on medical and other deductions, please contact CAUGHEY, LEGNER, & FREEHILL today. |

Our AuthorsWe thank you for visiting our law blog. The comments and articles written in this blog are not meant to replace the advice of a tax attorney or CPA. We also provide updates on social media. Archives

April 2020

Categories |

||||||||||||

HoursMon-Fri: 8:00am - 4:30pm

|

PONTIAC LOCATIONph: 815-842-1112

204 N. Main Street |

CHENOA LOCATIONph: 815-945-2611

213 Green Street |

Copyright 2020 - Terms of Use - All Rights Reserved

RSS Feed

RSS Feed